Both natural catastrophes—earthquakes, hurricanes, tornadoes, and floods—and man-made disasters can jeopardize the financial well-being of an otherwise stable, profitable company. Hurricane Andrew caused more than USD 16 billion in insured damage in 1992 and left at least 11 insurers insolvent. In 2011, natural catastrophes—including earthquakes in Japan and New Zealand, flooding in Thailand, and swarms of tornadoes in the United States—incurred insured losses of USD 110 billion, but did not cause a single insolvency—a testament to the importance of catastrophe modeling.

After a decade of below-average losses (apart from the aforementioned 2011), however, the large-loss catastrophes of 2017 serve as a reminder that preparing for large losses before they occur is critical to continued solvency and resilience. Standard actuarial techniques are insufficient because of the scarcity of historical loss data. Furthermore, the usefulness of the loss data that does exist is limited because the number and value of properties change, as do construction materials and building practices along with the costs of repair. Consequently, the limited historical loss information available is not suitable for directly estimating future losses.

In 1987, AIR Worldwide founded the catastrophe modeling industry and models the risk from natural catastrophes, terrorism, pandemics, extreme liability events, and cyber attacks, globally. Over the course of 30 years, our models have evolved as new science is vetted, new data and technologies become available, and the user marketplace demands solutions to new problems.

Catastrophe modeling has become standard practice in the property insurance and reinsurance industries, and is being increasingly adopted by other segments, among them casualty insurers and reinsurers, the financial industry, government, and non-governmental organizations (NGOs).

HOW CATASTROPHE MODELS ARE USED

The purpose of catastrophe modeling is to help companies anticipate the likelihood and severity of potential future catastrophes before they occur so that they can adequately prepare for their financial impact.

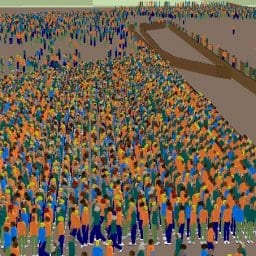

Catastrophe models can be used to where and how frequently future catastrophic events could occur, as well as how large they could be. By combining mathematical representations of the natural occurrence patterns and characteristics of hurricanes, tornadoes, earthquakes, severe winter storms, and other catastrophes, with information on property values, construction types, and occupancy classes, these simulation models provide information to companies concerning the potential for large losses.

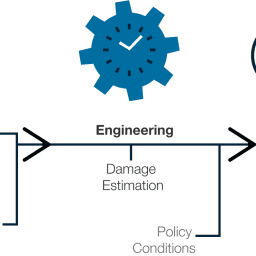

Insurers and reinsurers employ catastrophe models to estimate the loss potential to their books of business and to give them the tools and information they need to manage that risk. Model output is one source of information that companies use to develop and implement a wide range of activities: to set appropriate insurance rates and underwriting guidelines; analyze the effects of different policy conditions; conduct “what-if” analyses to measure the impact of various mitigation strategies; make sound decisions regarding the purchase of reinsurance; and optimize their portfolios.

Increasingly, organizations outside the insurance industry are employing catastrophe models to assess and manage their catastrophe risk, including government agencies, mortgage lending and other financial services companies, risk pools, and corporations and other owners of high-value real estate.

GLOBAL RESILIENCE PRACTICE

Governments also recognize the costs associated with limiting catastrophe risk management to disaster response. Government agencies, as well as non- governmental organizations (NGOs) are increasingly employing model output as they move from ex-post to ex-ante catastrophe risk management.

AIR’s Global Resilience practice provides governments and NGOs with solutions to help better prepare for and recover from disasters. Through catastrophe modeling we identify and quantify risks to populations and infrastructure, evaluate mitigation strategies, and inform disaster financing programs.

Jared Seaquist is Senior Business Development Executive at AIR Worldwide. AIR founded the catastrophe modelling industry in 1987 and contribute to advanced science and devise software and consulting services for catastrophe risk management, insurance-linked securities, site specific engineering analyses and agricultural risk management. For the IN-PREP project, AIR will adapt their Touchstone catastrophe modelling platform using models developed for earthquakes, terrorism and wildfire for the assessment layer of the Mixed Reality Preparedness Platform. This will enable effective information exchange between different levels of command of responders and shall be tested in live demonstrations during the third year of the project.